This is a paid advertisement sponsored by Upexi

Making Smart Investing Great Again: Quiet Company Unlocking 444% Growth In a Trillion Dollar Market

- Last year e-commerce hit 1 trillion dollars for the first time in history.[1]

- However as a whole, e-commerce growth has slowed and even titan Amazon has laid off 27,000 employees so far in 2023.[2]

- One company is still growing at a breakneck pace by helping high-margin companies with proven brands scale and increase profitability.

- Get to know Upexi now, before Wall Street takes note.*

– Staff at Wall Street Fundamentals

Smart investing isn’t always exciting; just ask Warren Buffett…

Widely regarded as the greatest investor, yet no one would call his strategy of buying stocks in companies that are undervalued but have strong fundamentals, strong management, competitive advantages, and potential for long-term growth, SEXY.

But what if a company making smart investments, in a similar manner, then leveraging them with giant distributors had a whopping 444% year-over-year growth in revenue last quarter?[3]

You would think most investors would instantly give that a second look… especially during these turbulent times on Wall Street.

As we all know, the pandemic forced consumers to change their buying habits from in-person to online purchasing, and as a result, e-commerce and tech skyrocketed.

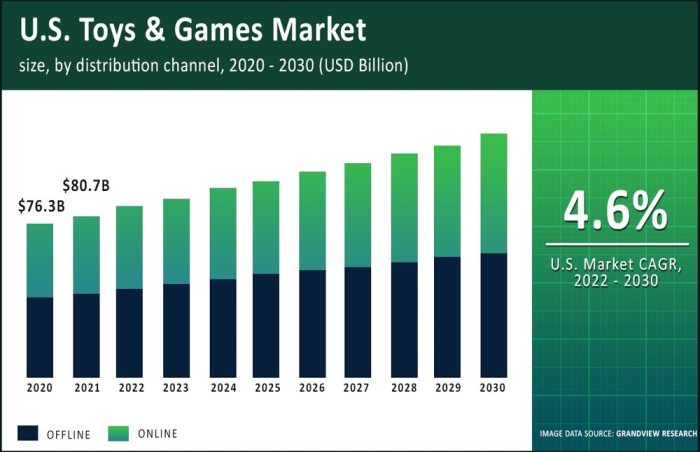

However, due to inflation and rising supply chain costs, the e-commerce sector hit a wall in 2022. In fact, US e-commerce growth slowed to the lowest levels over the past decade.[4]

Even Amazon isn’t immune, laying off 27,000 employees so far this year bringing the total when combined with other tech companies to 104,000 as of April 2023.[5] Combine that with slowed demand and lower valuations and the big names of e-commerce seem to have a big problem…

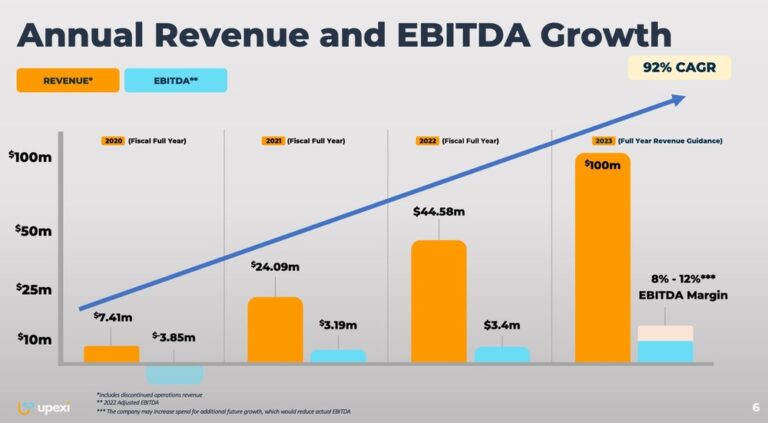

Meet the powerhouse, Upexi (UPXI), with a Compound Annual Growth Rate (CAGR) of a staggering 92% — 4.1x that of Amazon![6]

Upexi, a market-leading e-commerce brand owner and aggregator, has been quietly buying up established companies they believe to be on the brink of becoming massively profitable.[7]

While Wall Street flounders and brands are cutting costs left and right to try and preserve value, Upexi (UPXI) is aggressively growing and looking to double its size year over year!

The model: find stand-out businesses in growing sectors with talented leadership and upside potential. Use plug and play model to improve operations, full tech development, and cutting-edge advertising and distribution to quickly scale revenue and increase profitability.[8]

This simple, “familiar” model you’ll see more about has shown itself in a big way. In three years, e-commerce CAGR as a whole has experienced 21.9% growth[9], yet Upexi’s CAGR is a staggering 92%! *

With this kind of growth during these uncertain economic times, imagine what they can do in a favorable market!

That’s why now is the time to give Upexi (UPXI) a serious look.

So, while e-commerce is in the midst of a turbulent time, Upexi has experienced record growth creating the potentially perfect scenario for investors. Market sentiment has enabled a company with outstanding fundamentals to fly under Wall Street’s radar. *

Unlocking Potential in High-Growth, Recession-Proof Arenas

A strong business doesn’t have to be a complicated one. Just ask Starbucks. A bulletproof process and experience are nearly as important as the quality product they sell.

It all starts with strategically hand-picked businesses with great margins, customer data, and more importantly, primed for growth. Here are a few of the rapidly-growing diverse industries they are in:

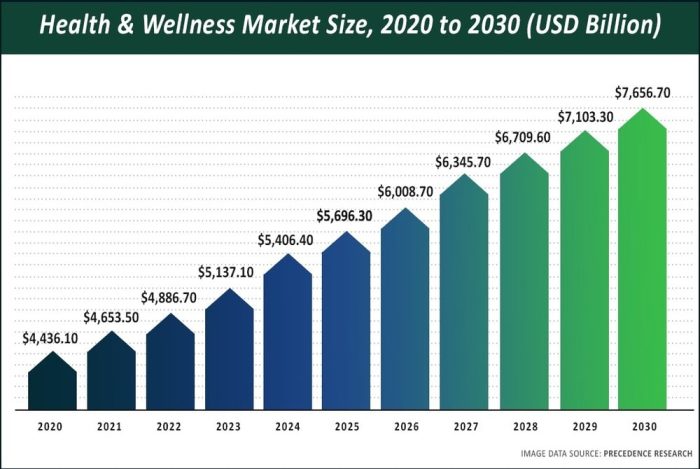

Health and wellness: The global health and wellness market was valued at $4,886.70 billion in 2022 and is expected to reach over USD 7,656.7 billion by 2030.[11]

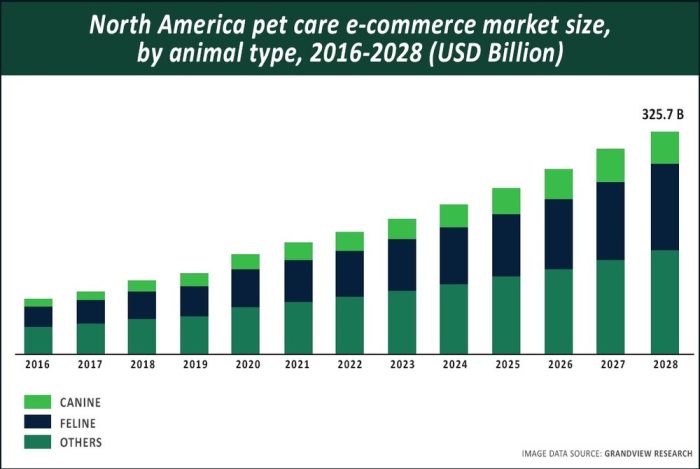

Pets: The global pet industry is expected to reach $325.74 billion in 2028 up from a value of $222.93 billion in 2021[13a]

While the numbers presented are global figures, it should be noted that the company mainly operates in the United States. They are expanding into the UK, Canada, and Australia with the intent of further worldwide expansion.[14]

Powerful Partners

So, Upexi has the right products, in the right markets, and through strategic relationships, they also have the partners and mediums to get them to consumers![15]

Now is the time to do your research and take a hard look at Upexi (UPXI) before it could potentially become one of the top 21st-century investments. *

Upexi is laser-focused on high-growth, high-margin, recession-resistant companies with rich consumer information. While the benefits are obvious, they’ve also figured out one of the biggest commodities in today’s digital economy: data.

Aggregating buyers across similar industries allows them to efficiently cross-sell existing buyers with in-house advertising. Simply put, Upexi can introduce its growing audience of loyal buyers to its other products for little to no cost — multiplying profits! *

In a data-driven economy, knowing what to do with loads of buyer information and trends is a very profitable and huge differentiator.

Upexi takes advertising a step further with its own SaaS programmatic advertising platform.[17] In addition to fueling growth and partnerships with large outside financial publishers, it allows Upexi to cost-effectively jumpstart its own product launches.

Having cutting-edge advertising technology is yet another strategic asset in this well-rounded portfolio.

Making the most of the $644 billion liquidation market to increase shareholder value[18]

The digital economy has created a boom of products and small brands, and as it grows, so do product returns.[19] You probably could have guessed that Upexi knows exactly how to capitalize on this. In addition to its direct-to-consumer (DTC) brands and ad platform, Upexi also owns two brand liquidation companies. This allows them to clean up on the other end of the buyer cycle and creates yet another revenue source for the company.

The man behind Upexi: Allan Marshall – Chief Executive Officer, Director

While Marshall doesn’t have household name recognition…yet, he’s certainly a well-known figure in the transportation and logistics world, and for good reason. In 2000 he founded Segmentz, Inc, a logistics company. While serving as the Chief Executive Officer he successfully acquired five distinct companies and raised over $25 million in capital. Ultimately this created the infrastructure and business foundation for what is now XPO Logistics, Inc., with revenues in excess of $17 billion.[20]

If Upexi was an expertly engineered race car, Marshall would be its perfect seasoned driver.

Check out Upexi (UPXI) now, before the market catches on.

A proven leader with an impressive transportation and logistics background lends itself well to having in-house distribution & logistics. With 4 distribution centers and 2 more on the way, they have the necessary distribution and warehousing to ship all their in-house brands further lowering costs and increasing profit margins.

Upexi is also well on its way to offering clients a full-scale Third-Party Logistics solution.[21]

Creating Value by Expanding Opportunity

The potential is undeniable – streamlining typical costly burdens like accounting, marketing, logistics, tech, and distribution can be difficult for small/medium-sized businesses. While Upexi steps in to consolidate these functions under its umbrella, it also aims to retain the current leadership of the companies it buys. Keeping the business founders in positions to do what they do best and leaving the growth to Upexi professionals is a win-win.

Those who know best believe in the process, clearly reflected by the high inside ownership, at 54%.[23] This represents remarkable optimism for the company’s future growth.

Not only is this company growing rapidly while the giants are making lay-offs, but it’s taking the founders and staff with them as stockholders!

There’s a Good Reason Why Insiders Have Been Buying at These Levels!

While big tech and e-commerce companies are lowering projections and tempering expectations, Upexi continues to scale, build, and refine its diverse portfolio of promising brands to help move towards its $100M revenue goal in 2023![24]

7 Reasons Why Investors Should Pay Attention to Upexi (UPXI)

- Diversification: Multiple brands that span growing, high-profit, recession-proof industries.

- Reach: In-house SaaS advertising platform with targeted advertising solutions.

- A to Z: Brand liquidation companies to capitalize on returns and excess inventory.

- Shipping: In-house distribution and logistics across the US primed for Third-Party Logistics (3PL).

- Pride: Retains passionate founders of these American companies as they scale.

- Management: CEO previously started a company that went on to surpass $17 billion.

- On pace for 100M in revenue in 2023 with just a 76M market cap as of this writing.[25]

Bottom Line: Upexi (UPXI) may be an early-stage company, which no doubt carries risk, but how many companies can boast this kind of explosive year-over-year growth out of the gate? These are the kinds of opportunities that require your attention and research. With a model continually proving itself in high-growth industries with proven management…during a down market, you’d hate to look back with regret.*

Don’t wait to research Upexi (UPXI) while this company is still overlooked by Wall Street, trading at just a few dollars as of April 2023.[26] This company, quietly raking in multi-millions, seems bound to show up on mainstream radar soon.

While investing in UPXI looks to have the potential for higher rewards than other larger companies, it also comes with higher risk.* And, of course, past performance is no guarantee of future results.

We always encourage your own due diligence. Don’t act on this advertisement alone; see for yourself why this company is so appealing. And, as always, never invest more than you can afford to lose.*

~ Wall Street Fundamentals Team

P.S. Still want more information on Upexi Inc. (UPXI)?

I’d like to offer you access to Upexi’s Investor Presentation, which you can have at no charge.

I’ll also begin a free subscription for you to our online investor newsletter, WallStreetFundamentals.com.

Sign up below to learn about this investment opportunity.

By signing up above you will receive the Wall Street Fundamentals newsletter and 3rd party advertisements. Expect up to 5 messages per week from us. You can unsubscribe at any time at the bottom of any of our emails.

ADVERTISEMENT DISCLAIMER

This paid advertisement includes a stock profile of Upexi (UPXI). To enhance public awareness of UPXI and its securities, the issuer has provided Promethean Marketing, Inc. (“Promethean”) with a total budget of approximately fifty thousand dollars ($50,000.00) USD to cover the costs associated with this advertisement for a period beginning 24 August 2023 and currently set to end 29 September 2023. This compensation should be viewed as a major conflict with our ability to be unbiased. The website hosting this advertisement, Wall Street Fundamentals, is owned by Promethean. As a result of this advertisement, Wall Street Fundamentals may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. Promethean will retain any excess sums after all expenses are paid. As of the date this advertisement is posted to the Wall Street Fundamentals website, some or all of Promethean or Wall Street Fundamentals and any of their respective officers, principals, or affiliates (as defined in the Securities Act of 1933, as amended, and Rule 501(b) promulgated thereunder) may hold the securities of UPXI and may sell those shares during the course of this advertising campaign. This advertisement may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of UPXI, increased trading volume, and possibly an increased share price of UPXI’s securities, which may or may not be temporary and decrease once the advertising campaign has ended. This communication is based on information generally available to the public and on interviews with UPXI Management, and does not (to the Publisher’s knowledge, as confirmed by UPXI) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, neither Promethean or Wall Street Fundamentals cannot guarantee the accuracy or completeness of the information. To more fully understand the Wall Street Fundamentals website or service, please review its full Disclaimer and Disclosure Policy located here.

* See our Important Notice and Disclaimer above for a detailed discussion on compensation, risks, atypical results, and more.

[1] https://www.digitalcommerce360.com/article/us-ecommerce-sales/

[2] https://www.cnbc.com/2023/01/18/tech-layoffs-microsoft-amazon-meta-others-have-cut-more-than-60000.html

[3] https://ir.upexi.com/news-events/press-releases/detail/53/upexi-reports-record-revenue-of-27-1-million-for-fiscal

[4] https://www.digitalcommerce360.com/article/us-ecommerce-sales/

[5] https://www.cnbc.com/2023/01/18/tech-layoffs-microsoft-amazon-meta-others-have-cut-more-than-60000.html

[6] https://finbox.com/NASDAQGS:AMZN/explorer/total_rev_cagr_3y/ + https://ir.upexi.com/financial-information

[7] Upexi.com

[8] Upexi.com

[9] https://www.digitalcommerce360.com/article/us-ecommerce-sales/

[10] https://d1io3yog0oux5.cloudfront.net/_261d91bf8428b46166be1ccc076c628e/upexi/db/2265/21364/pdf/UPEXI+Deck+02_14_23+Final++.pdf

[10] Chart https://www.precedenceresearch.com/health-and-wellness-market

[11] Image data sourced from https://www.precedenceresearch.com/health-and-wellness-market

[12] Image data sourced from https://www.grandviewresearch.com/ind

[13a] https://www.zippia.com/advice/pet-industry-statistics/

[13b] https://www.grandviewresearch.com/industry-analysis/pet-care-ecommerce-market

[14] https://d1io3yog0oux5.cloudfront.net/_46a1d14013bd2ce09a5272ad19353483/upexi/db/2265/21364/pdf/UPEXI+IR+05_05_23.pdf

[15] Upexi.com

[16] https://upexi.com/brands and https://www.neticentral.com

[17] https://upexi.com/scale

[18] upexi.com

[19] https://www.liquidationmap.com/liquidation-in-2023-what-resellers-that-like-to-buy-low-and-sell-high-should-know/ and https://www.marketplace.org/2023/01/27/inside-the-booming-business-of-reselling-returned-merchandise/

[20] Upexi.com

[21] Upexi.com

[22] Upexi.com

[23] https://d1io3yog0oux5.cloudfront.net/_46a1d14013bd2ce09a5272ad19353483/upexi/db/2265/21364/pdf/UPEXI+IR+05_05_23.pdf page 16

[24] https://d1io3yog0oux5.cloudfront.net/_46a1d14013bd2ce09a5272ad19353483/upexi/db/2265/21364/pdf/UPEXI+IR+05_05_23.pdf pg 17

[25] https://d1io3yog0oux5.cloudfront.net/_46a1d14013bd2ce09a5272ad19353483/upexi/db/2265/21364/pdf/UPEXI+IR+05_05_23.pdf

[26] https://finance.yahoo.com/quote/UPXI?p=UPXI&.tsrc=fin-srch

Ad References:

https://www.investing.com/academy/analysis/warren-buffett-investment-strategy-rules-fortune/#:~:text=Warren%20Buffett’s%20investment%20strategy%20has,them%20for%20the%20long%20term

https://www.cnbc.com/2023/01/18/tech-layoffs-microsoft-amazon-meta-others-have-cut-more-than-60000.html

https://www.investing.com/academy/analysis/warren-buffett-investment-strategy-rules-fortune/#:~:text=Warren%20Buffett’s%20investment%20strategy%20has,them%20for%20the%20long%20term